Summary

2. COSTS OF BRAZILIAN TAXATION

3. A CONSTITUTIONALIZED AND DECENTRALISED TAXATION

4. THE COMPLEXITY OF INDIRECT TAXATION

4.1 Decentralization

4.2 The complexity of tax collection procedures – Basis for calculating includes the tax itself

5. THE CURRENT WILL TO REFORM

5.1 The tax reform procedure

5.2 Involvement of federated entities

5.3 The vote on Proposals for Constitutional Amendments-PEC nº 45 and 110

5.4 Infra-constitutional norms

6. CONTENT OF THE REFORM ADOPTED BY THE HOUSE OF REPRESENTATIVES

6.1 Scope of the reform

6.2 Creation of two VATs: CBS and IBS

6.2.2 Extended basis of calculation and net price

6.2.3 Rate

6.3 Creation of a selective tax – IS

6.4 Transition arrangements between the current system and the new regime

6.5 Comparative table between the current and the new regime

7. THE EXPECTED EFFECTS OF THE REFORM

7.1 – The end of the tax war

7.2 – Legal certainty

7.3 – Transparency:

7.4 – Reduction of the tax burden on exports:

7.5 – Economic growth

7.6 – Reduction of social inequalities

1 – BRAZIL COST

« Brazil cost » refers to the increased operational costs associated with doing business in Brazil, in comparison with the OECD average.

Brazilian economic actors, mainly manufacturers, regularly highlight the amount of these costs that impact their competitiveness.

The Brazilian public authorities themselves are fully aware of these specific costs and are mobilized to reduce them.

But what exactly are we talking about? inadequate infrastructure; judicialization of employment; bureaucracy; low-skilled labour; cost of financing; legal uncertainty and, above all, a complex indirect taxation.

According to studies carried out by the MBC (Movimento Brasil Competitivo) with the Ministry of Development, Industry, Trade and Services (MDICS), the cost of Brazil represents about 340 billion USD per year, or 22% of Brazil’s GDP.

In its report “Brazil competitiveness 2019-2020″ the National Confederation of Industries-CNI highlights improvements in bureaucracy, employment relations, innovation, technology and competitiveness. But it recalls that the costs of capital (financing costs) and the costs related to tax complexity persist.

2 – COSTS OF BRAZILIAN TAXATION

Among the 14 proposals of the CNI to improve production and growth, “modernizing indirect taxation” appears in priority.

Brazil’s tax burden is 33% of GDP, roughly in line with the OECD average, but without providing public services at the same level as those of these countries.

To this tax burden must be added the costs associated with a complex, costly and time-consuming tax system for companies. According to the World Bank, Brazilian companies consume more than 1500 hours per year to deal with their tax issues, more than 6 times the world average. One in 200 Brazilian employees is dedicated to accounting matters, while in the United States and Europe it is 1 in 1000 and one in 500 respectively.

According to IBPT (Instituto Brasileiro de Planejamento Tributário) Brazilian companies consume 1.5% of their annual turnover in tax bureaucracy, i.e., in 2016, 12 billion dollars to calculate and pay taxes (not the taxes themselves).

According to Bernard Appy, specially appointed by the federal government to lead the tax reform, it should increase growth from 12% to 20% over the next 15 years. For the president of the Central Bank of Brazil, Roberto Campos Neto, 1.5% growth should be won in the first year of implementation of the reform.

3 – A CONSTITUTIONALIZED AND DECENTRALISED TAXATION

The Brazilian tax system as it exists today dates from the 60s. It was amended by the Federal Constitution of 1988.

The 1988 Federal Constitution marked the end of the military regime and the beginning of a new democratic era under the rule of law.

Brazilians, exalted by the return to freedom and democracy, have used the Federal Constitution of 1988 to engrave in stone the great principles of the new society of law that they wanted to implant. They thus have produced a long and exhaustive constitution that lists many principles in all fields.

The fiscal organization is provided in accordance with the essential principle of the Brazilian democrats: the principle of decentralization. Every period of democratic revival in Brazil’s history coincides with a strengthening of the federal system.

The constitution will therefore assign a specific fiscal competence to each entity of the federation: Union; States and Municipalities

- (i) Union: taxes on imports; on exports; on industrialized products; income; financial transactions; rural property and the major fortunes.

- (ii) States: donations and inheritances; transfer of goods, transport and communication; motor vehicles.

- (iii) Municipalities: urban property tax; transfer tax on real estate; tax on services.

Moreover, the Union has a monopoly on social contributions, which the Constitution allows to collect on economic activity, such as an indirect tax.

4 – THE COMPLEXITY OF INDIRECT TAXATION

4.1 – Decentralization

The concurrent tax jurisdiction between the three entities of the Federation of Brazil has generated a first disorder in the management of indirect taxation (consumption taxation).

In Europe, VAT applies uniformly to all economic activities. The rates may differ according to the social value given to the goods and services concerned, but the mechanism of calculation and payment is uniform.

In Brazil, depending on whether the activity is a trade or a service, taxation will be totally different, knowing that the service will be taxed by the Municipalities and the trade by the States, according to different processes.

This competition has generated tax wars between entities. For example, when an activity is both a service and the sale of goods (restaurant) or when it comes to software trading by Saas.

A fiscal war has also been established between the states among themselves, and the municipalities among themselves. Which State or Municipality is due the tax in: address of the provider? Address of the beneficiary? Both?

Currently, indirect taxation is divided into 6 (six) taxes and contributions.

UNION

- Import Tax – II

- Tax on Industrialized Products – IPI

- Contribution for the financing of social security – COFINS

- Social Integration Programme – PIS

STATES

- Tax on the Transfer of Goods and Services – ICMS

MUNICIPALITIES

- Tax on services-ISS

4.2 – The complexity of tax collection procedures – Basis for calculating includes the tax itself

Unlike the VAT applied in Europe, the Brazilian taxpayer must calculate his indirect taxes by including in the calculation basis the tax itself. This principle applies to ICMS, PIS and Cofins.

|

5 – THE CURRENT WILL TO REFORM

Tax reform has been considered essential for Brazil’s economic growth for decades, but the difficulties in implementing it are such that it has never been able to move forward. It seems that now, with PEC 45, the step has been taken and a consistent reform should be adopted by the end of this year 2023.

5.1 The tax reform procedure

The main fiscal principles were laid down in the Federal Constitution of Brazil of 1988 (Art. 145 et seq.), which freezes them and makes them difficult to modify. To do so, it is necessary to follow the procedure of the Constitutional Amendments (“Emendas Constitucionais – EC“).

In the same way as ordinary laws, constitutional amendments must be voted by the House of Representatives and then by the Senate but, unlike ordinary laws, they require a qualified majority of 3/5 of the members of each assembly, in two rounds.

This majority is even more difficult to obtain as Brazilian political representation is very fragmented with more than twenty political parties represented, without voting discipline. Each elected member must be convinced one by one.

5.2 Involvement of federated entities

In addition to the need to have a positive vote of at least 3/5 of the members of Congress, it is also necessary to be able to convince the federated states and municipalities for which the reform directly impacts their personal tax power and can significantly affect their revenues.

5.3 The vote on Proposals for Constitutional Amendments-PEC nº 45 and 110

PEC 45 was proposed by members of the House of Representatives in 2019, while PEC 110 was proposed by senators, also in 2019, in accordance with the conditions set by Article 60 of the Federal Constitution.

Representatives voted for PEC 45 in two rounds on 07.07.2023, by a large majority. The result of the first round was 382 in favour and 118 against. The result of the second round was 375 Representatives in favour against 112. Then, the text has been sent to the Senate, which will also have to adopt it in two rounds by 3/5 of its members.

A work schedule in the Senate should be set for the week of 14.08.23, knowing that the rapporteur in the Senate (Senator Eduardo Braga) has indicated that he should submit his final report by the end of October 2023. The vote of the Senate in plenary session, in two rounds, should take place a few weeks later.

It is likely that the Senate will conduct a more in-depth analysis of the project, as announced in the media, particularly with regard to the sectors benefiting from the reduced rates.

If the Senate changes the bill substantially, then the bill will have to return to the House of Representatives for a new vote. Otherwise, it will be submitted to the President of the Republic for promulgation.

5.4 – Infra-constitutional norms

After the adoption of the constitutional reform, the rules for its implementation shall be provided by complementary laws and ordinary laws.

6 – CONTENT OF THE REFORM ADOPTED BY THE HOUSE OF REPRESENTATIVES

6.1 – Scope of the reform

The reform does not address income tax, which is an exclusively federal tax. It only concerns indirect taxes and contributions, as well as other taxes under the jurisdiction of the States and Municipalities.

The new indirect taxes (consumption taxes) provided for by the reform are:

- The Contribution on Goods and Services (CBS)

- Goods and Services Tax (IBS)

- Selective tax – IS

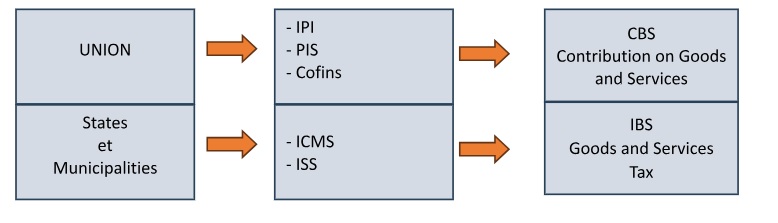

6.2 – Creation of two VATs: CBS and IBS

The main reform, which should substantially reduce costs for the economy, concerns the current 5 (five) taxes and indirect contributions that will be grouped into two categories of VAT called Tax on Goods and Services – IBS and Contribution on Goods and Services – CBS.

CBS and IBS should be considered as one and the same tax, as they will have the same legislation and mechanisms. Only the applicable rate and the recipient will vary.

With regard to the IBS, the local authority that will collect the tax will be the one of destination of the goods or services.

6.2.1 – Extended basis of calculation and net price

6.2.1.1 – Extended basis for calculation: both CBS and IBS will apply to all goods and services, tangible and intangible.

All imports will be subject to CBS and IBS, including those made by usually non-taxpaying natural or legal persons.

6.2.1.2 – the net price: both CBS and IBS will be calculated on the net price, without including the own contribution or tax (“por fora” calculation), in the same way as VAT in Europe.

6.2.2 – Rate

The federal constitution is not the appropriate instrument for setting the tax rate. Therefore, PEC 45 does not set a rate. This must be provided for in the federal law and the state and municipal laws.

A standard rate shall be set by the Senate.

6.2.2.1 – The standard rate

In setting this standard rate, the Senate will have to consider several factors:

- The revenue obtained with the new Selective Tax – IS (cf. 6.3 below)

- Revenue obtained from taxes on activities subject to specific taxation (see 6.2.2.3 below);

- The extent of goods and services that will benefit from a reduced rate (see 6.2.2.2 below);

- The “compliance gap” (tax fraud; divergence of legal interpretation between the taxpayer and the tax authorities; judicialization; level of tax fraud)

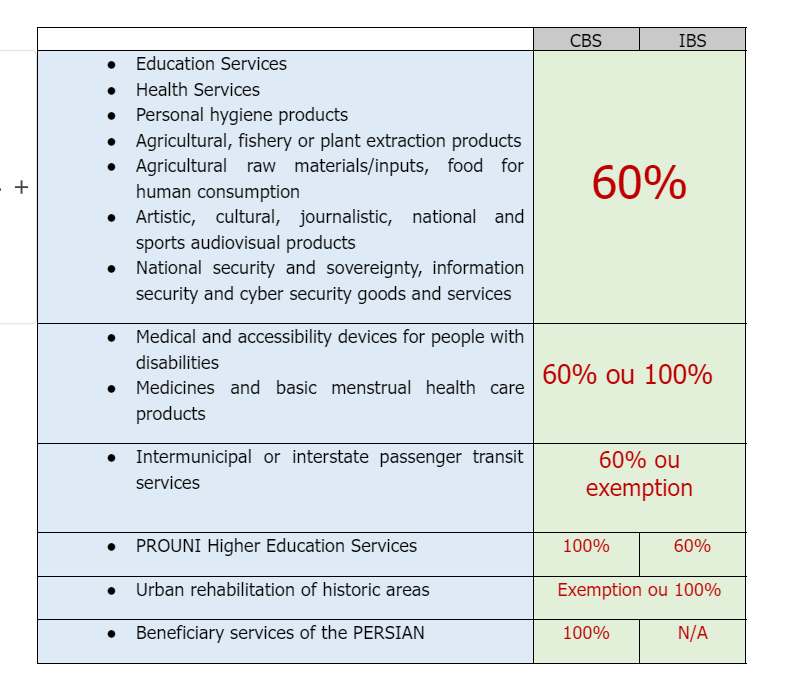

6.2.2.2 – The reduced rate

A complementary law will determine the activities and products that may benefit from a reduced rate of 60%, 100% or exemption from the standard rate, in the following sectors:

In addition, there is a mechanism called “cashback” by which the most humble population would be reimbursed indirect taxes paid on consumption.

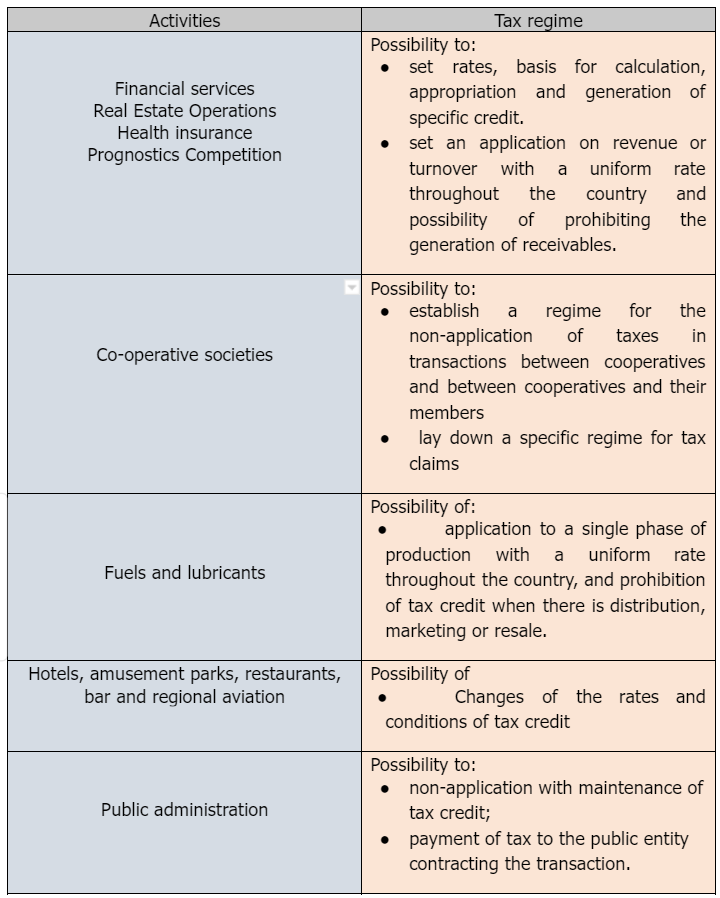

6.2.2.3 – Sectors with specific tax regime

In addition to fixing specific rates, the complementary law may also set specific regimes for the following activities:

6.3 – Creation of a selective tax – IS

The selective tax-IS is created with the objective of taxing goods and services that harm health and the environment. These goods and services will be listed by law.

The revenues obtained with the IS will be distributed at 40% for the Union and 60% for the States, the Municipalities and the development programs of the North, North-East and Centre-West regions.

6.4 – Transition arrangements between the current system and the new regime

A transitional period of 7 years is set as follows:

2026: rate of 0.9% of CBS and 0.1% of IBS, without elimination of old taxes, but which can be offset with the PIS/Cofins;

2027: CBS fully applies and replaces PIS/Cofins. The IPI rate is reduced to 0%.

2029 to 2032: Gradual increase in the IBS rate and proportional gradual reduction in the ISS and ICMS rates.

2033: End of the transition period. The new regime applies fully.

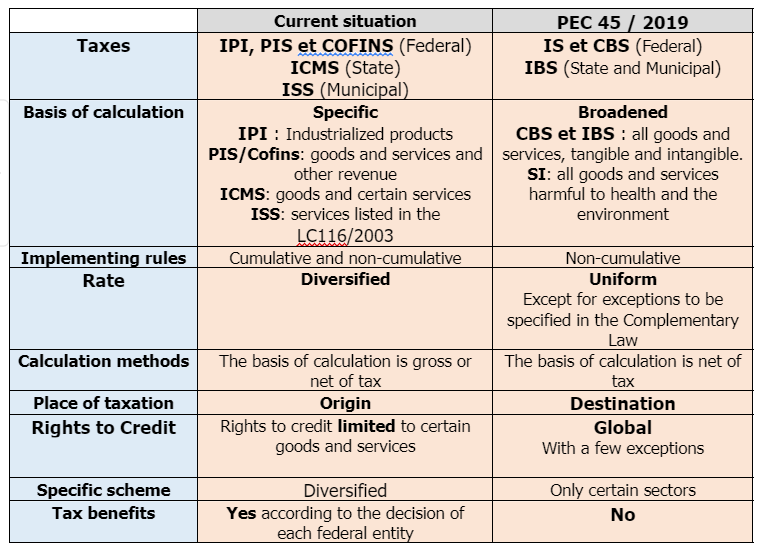

6.5 – Comparative table between the current and the new regime

7 – THE EXPECTED EFFECTS OF THE REFORM

7.1 – The end of the tax war: with the current system, states and municipalities are engaged in a tax war by reducing rates in order to attract companies to their jurisdiction.

7.2 – Legal certainty: Simplifying the tax system should reduce differences in interpretation between the tax authorities and the taxpayers.

7.3 – Transparency: By using the net tax basis method, taxpayers will have more clarity on the amount of taxes they pay.

7.4 – Reduction of the tax burden on exports: Since taxes are paid on consumption, they will not be paid on export.

7.5 – Economic growth: Simplifying the system will reduce the time companies spend calculating and paying their taxes, opening up additional time for wealth creation.

7.6 – Reduction of social inequalities: thanks in particular to the “chashback” which will allow poor families not to pay taxes on consumption.

READ ALSO:Foreign Capital Registration in Brazil

Seeking legal assistance/consultation regarding investiments in Brazil?

Solere Advogados Associados can help: we are a law firm specialized in Brazilian business law, with practice in tax, corporate, commercial, labor, civil, specially on M&A, transactions, business partnership negotiations and any other form of foreign business implantation.

Contact us:

Phone number:55 21 981-01-61-51

WhatsApp message (click this link to open the app) or e-mail.